Secure Guide: Best DeFi Apps 2026 on FoxWallet

DeFi in 2026 is not just about picking a few famous protocols. It is about navigating a multi-chain world safely, minimizing hidden costs, and keeping your self-custody setup resilient against phishing, malicious approvals, and smart contract risk. In my view, the "best" DeFi apps in 2026 are the ones that remain useful even when narratives change: core liquidity venues, battle-tested lending markets, widely adopted liquid staking protocols, and the stablecoin rails that everything else composes on.

Just as important: the wallet you use becomes your security perimeter and your daily DeFi interface. FoxWallet is built as a multi-chain decentralized wallet (non-custodial), with local encryption, risk alerts, smart contract recognition, built-in DApp access, and a cross-chain swap aggregator designed to reduce slippage and hidden costs. That combination matters more in 2026 than it did in earlier cycles, because DeFi is increasingly fragmented across L1s, L2s, and app-specific chains.

What "best DeFi apps 2026" should actually mean

Most lists treat "best" as "highest TVL" or "most hyped." TVL and popularity matter, but in 2026 you should judge DeFi apps through a more practical lens: survivability, composability, and day-to-day user safety.

Here is the rubric I use:

- Security track record and audit maturity: Long-running contracts with repeated scrutiny tend to fail less often than brand-new primitives. Even so, incidents still happen (for example, some Curve pools were impacted by the Vyper compiler bug in 2023, which is a reminder that "audited" is not a guarantee). Curve's own resources and incident writeups are a good reference point for how mature protocols communicate risk (see Curve resources).

- Ecosystem role (composability): The most durable DeFi apps are "money legos" other apps rely on: major DEX liquidity, core lending markets, widely used collateral like stETH, or stablecoin systems like DAI.

- Multi-chain availability where it counts: In 2026, "best" often means "available on the chain you actually use," whether that is Ethereum L2s, Solana, or a specialized appchain.

- UX that reduces irreversible mistakes: Clear transaction review, safer dApp discovery, and fewer opportunities to sign the wrong approval are not "nice to have." They are the difference between participating and opting out.

A final point that is often missed: the "best app" is the app you can access safely. That is where a non-custodial, security-first wallet with strong multi-chain support becomes part of the definition.

2026 DeFi trends that change what apps you will use (and how)

By late 2025 into 2026, several themes show up consistently across research and market commentary:

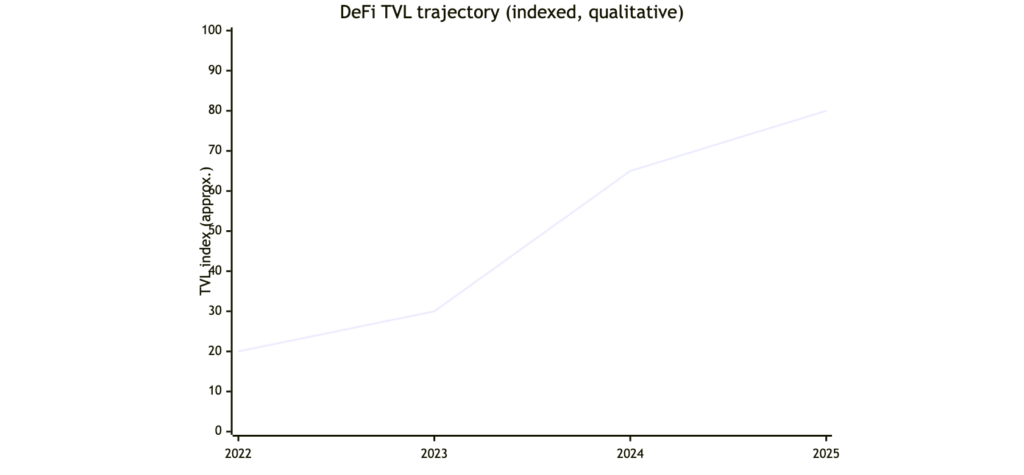

- TVL recovery with volatility: DeFi rebounded materially from the 2022 crash, with multiple sources describing a strong 2024 recovery and a volatile but larger 2025 market, depending on methodology and timing (see TVL commentary from Gate.io research, historical framing from Statista, and trend coverage from DL News).

- Layer-2 and high-throughput chains keep pulling activity: Cheaper execution changes behavior. Smaller users can rebalance more often, and perps and aggregators get more use when costs drop.

- Cross-chain is normal (and still risky): Users move across ecosystems to chase better liquidity, cheaper execution, or specific apps. That increases exposure to phishing, spoofed front-ends, and routing complexity.

- Wallet UX becomes the frontline: Users want pre-transaction risk signals, contract recognition, and fewer "blind signatures," especially on mobile-first flows (a theme echoed across wallet landscape writeups like Alchemy's Web3 wallet overview).

A practical shortlist: leading DeFi apps by category (2026 outlook)

Quick comparison table (what each category is for)

| Category | What you use it for | Representative leading apps (official sites) | Main risk to respect |

|---|---|---|---|

| DEX / AMM | Swapping tokens, providing liquidity | Uniswap, Curve, PancakeSwap, Jupiter | Smart contract risk, pool-specific incidents, spoofed front-ends |

| Lending / Borrowing | Collateralized loans, earning interest | Aave, Compound, JustLend | Liquidations, oracle risk, collateral risk |

| Liquid staking (not cross-chain) | Keep staking exposure while staying liquid | Lido, Rocket Pool, Ether.fi | Depeg risk, validator and smart contract risk |

| Stablecoins / Money markets | DeFi "cash," borrowing against crypto | MakerDAO, Frax | Stablecoin mechanism risk, collateral risk |

| Yield / structured yield | Auto-optimizing strategies, yield markets | Yearn, Beefy, Pendle | Strategy complexity, dependency risk on underlying protocols |

| Perps / derivatives | On-chain leverage and hedging | dYdX, GMX, Drift | Leverage risk, oracle risk, liquidation engines |

DEX and AMM leaders: where liquidity and routing concentrate

- Uniswap remains the default liquidity venue across Ethereum and major L2s for many assets. The reason it stays "best" is not marketing, it is composability: many aggregators and wallet routes still rely on Uniswap liquidity. For technical background, start with the Uniswap documentation.

- Curve stays central for stablecoin and like-asset swaps, which makes it foundational for many yield strategies. Its history also illustrates an important 2026 lesson: even mature protocols can experience incidents at the pool or dependency level, so you still need to manage approvals and exposure (see Curve resources).

- PancakeSwap continues to dominate retail-heavy flows in its ecosystems and remains a common choice for users who prioritize breadth of tokens and a familiar DEX UX (see PancakeSwap docs).

- Jupiter is a key reason Solana DeFi feels "one-click" when it works well: it routes across Solana venues and is repeatedly highlighted in Solana-specific 2026 lists (see Jupiter and Eco's Solana guide).

My take: in 2026, aggregators and deep liquidity matter more than brand. Users increasingly choose "best route" rather than "best DEX."

Lending and borrowing: still the clearest product-market fit in DeFi

- Aave is consistently treated as the category benchmark due to longevity, multi-chain deployments, and risk tooling (isolation mode, eMode). If you want to understand how seriously it treats risk controls, read the Aave security documentation.

- Compound is older but remains part of DeFi's backbone and a reference implementation for algorithmic interest rates (see Compound docs).

- JustLend is often mentioned for Tron-centric DeFi usage in 2026 lists (see JustLend).

Opinionated caution: lending "feels safe" because the UI looks like a bank account. But liquidation mechanics do not care about your feelings. In 2026, safe lending behavior is mostly about conservative collateral choices and respecting liquidation thresholds.

Liquid staking: useful, but treat it as its own risk bucket

Liquid staking belongs in a separate mental box from cross-chain activity. It is not "just staking." It introduces derivative and depeg risk.

- Lido is repeatedly described as a top protocol by TVL and is widely used as collateral through stETH. Its own documentation is very direct about risk tradeoffs (see Lido docs and stETH security guidance).

- Rocket Pool is a long-running alternative emphasizing decentralized node operation (see Rocket Pool).

- Ether.fi appears in "projects to watch" style 2026 lists, reflecting continued appetite for new staking primitives (see Ether.fi).

My take: liquid staking can be "best" for composability, but it is rarely best for simplicity. If you cannot explain the depeg risk in one sentence, size down.

Stablecoins and money markets: the rails that make everything else work

- MakerDAO and DAI remain the canonical decentralized stablecoin system for many DeFi strategies (see MakerDAO and Maker docs).

- Frax is often cited as innovative but more complex in design (see Frax and Frax docs).

The 2026 reality: stablecoins are not just "cash." They are protocols with risk parameters, collateral baskets, governance, and market structure.

Yield aggregators and structured yield: powerful, complexity is the fee

- Yearn helped define vault-based yield strategy UX (see Yearn docs).

- Beefy is widely used for multi-chain auto-compounding vaults (see Beefy docs).

- Pendle represents the "yield becomes a tradable primitive" direction (see Pendle docs).

Opinion: in 2026, the best yield product is the one you can unwind safely. Complexity compounds risk faster than APR compounds returns.

Perps and derivatives: mature enough to be mainstream, still unforgiving

- dYdX continues to be a key on-chain perps venue, with a move toward an appchain model that changes infrastructure tradeoffs (see dYdX docs).

- GMX remains a major on-chain perps design, with its own risk profile around oracles and pool composition (see GMX docs).

- Drift is frequently cited in Solana DeFi lists as a perps and margin trading venue (see Drift and Eco's Solana guide).

If you trade perps in 2026, "best" should mean: transparent liquidation rules, reliable oracle design, and a UX that makes leverage impossible to ignore.

The security layer most "best app" lists ignore: your wallet setup

Most people searching best defi apps 2026 are not only shopping for protocols. They are also looking for a way to use them without getting drained.

This is where FoxWallet's design choices map directly to real 2026 pain points:

- Non-custodial control: You retain full control over private keys and assets. FoxWallet does not custody your funds.

- Local encryption and sandbox isolation: Your sensitive credentials are stored locally with encryption, reducing exposure.

- Pre-transaction risk alerts and smart contract recognition: Helps you catch suspicious interactions before signing.

- Built-in DApp access: Reduces tab-hopping and the risk of landing on a spoofed site.

- Multi-chain asset management and real-time sync: A unified view matters when your assets are scattered.

- Built-in cross-chain swap aggregation: Cross-chain routing can reduce operational friction while aiming to minimize slippage and hidden costs.

A 2026 checklist before you connect to any DeFi app

Use this list regardless of which protocol you choose:

- Verify you are in the right place: Prefer accessing apps from official documentation pages (for example, start at the Uniswap docs rather than trusting ads).

- Treat approvals as power-of-attorney: Token approvals are often the real attack surface. Keep approvals tight and avoid infinite approvals when you do not need them.

- Assume "audited" means "lower risk," not "no risk": Mature protocols can still suffer incidents through dependencies, oracles, governance, or integrations.

- Do not chase yield across too many layers: Stacking leverage, liquid staking derivatives, and complex strategies increases correlated failure modes.

- Separate behaviors by mental model:

- Cross-chain activity: routing risk, bridge risk, phishing risk, fee opacity.

- Staking and liquid staking: validator risk, depeg risk, smart contract risk.

Keeping these separate helps you avoid accidental "strategy soup."

How I would build a safer DeFi routine on FoxWallet in 2026 (beginner to advanced)

This is an opinionated operating system you can adapt. It is meant to reduce irreversible mistakes while still letting you access leading DeFi apps.

Step 1: Start with self-custody hygiene (before chasing returns)

- Create a new wallet and back up your recovery phrase securely.

- Use device-level security (biometrics, secure lock screen).

- Keep a "daily" wallet and a "vault" wallet mindset if your activity grows (daily for routine DeFi, vault for long-term holdings).

Step 2: Choose one chain to learn, then expand intentionally

In 2026, multi-chain is normal, but learning everything at once is how people get phished.

- If you are primarily using Ethereum DeFi, start with a DEX and a lending market you can explain.

- If you are Solana-first, start with an aggregator and keep token lists tight.

Step 3: Use categories as your guardrails (not just app names)

A simple progression:

- DEX: make one small swap, confirm you understand gas, slippage, and the confirmation flow.

- Lending: supply only, observe rates, then borrow only if you understand liquidation.

- Liquid staking: treat it as a separate decision, sized smaller until you understand depeg risk.

- Perps: only after you can manage collateral, liquidation, and platform mechanics.

Step 4: Lean on wallet-level risk signals and reduce context switching

FoxWallet's risk alerts and smart contract recognition are designed to catch common mistakes at the moment that matters: before signing. Combine that with the built-in DApp access so you are not constantly bouncing between links, networks, and pop-ups.

Step 5: Make cross-chain activity boring (and that is a compliment)

Cross-chain is where hidden costs and confusion tend to pile up. A built-in cross-chain swap aggregator can reduce the number of steps and help optimize routing, but your discipline still matters:

- Keep transfers purposeful (do not "just explore" with large size).

- Expect fees: gas plus protocol and routing costs may apply depending on the route.

- Screenshot and record what you did the first few times, so you can debug calmly if something looks off.

A simple "best apps" starter stack (example)

This is not a recommendation, just a practical template many users follow:

- One major DEX for your main ecosystem (for example, Uniswap on EVM or Jupiter on Solana).

- One major lending market (for example, Aave).

- One stablecoin system to understand deeply (for example, MakerDAO).

- Optional: one yield platform only after you can explain the strategy (for example, Yearn or Pendle).

Final thoughts: "best" is what you can use safely, repeatedly, and with confidence

In 2026, DeFi winners are still protocols, but user outcomes are increasingly determined by wallet-level safety and multi-chain execution quality. The market is bigger and more usable than the 2022 era, yet the attack surface has also expanded with more chains, more bridges, and more lookalike front-ends.

If you are evaluating the best defi apps 2026, my advice is to decide on two tracks at the same time:

- A shortlist of category-leading protocols with durable roles.

- A security-first, non-custodial wallet experience that helps you manage multi-chain complexity without drowning in hidden costs or risky clicks.

FoxWallet is built for that reality: self-custody by default, multi-chain asset management, deep DeFi and DApp integration, pre-transaction risk alerts, and cross-chain swap aggregation designed to reduce friction and unnecessary overhead.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. DeFi involves risk, including smart contract risk, liquidation risk, and loss of funds. Always do your own research before interacting with any protocol.