Multi-Chain Stablecoin Wallet with Low Fees

Choosing a multi-chain stablecoin wallet is mostly about solving three problems at once: tracking the same stablecoin across different networks, moving it without overpaying, and staying safe while you self-custody your funds. Below is a practical comparison focused on low fees, multi-chain coverage, and security-first UX, with FoxWallet as the reference point.

What a multi-chain stablecoin wallet actually does (and why it matters)

Stablecoins are cryptocurrencies designed to hold a relatively stable price, often pegged 1:1 to a fiat currency like the US dollar, which makes them popular for payments, trading, and value storage. If you want a concise definition and use cases, Coinbase's overview is a solid reference: what stablecoins are and why they exist.

Where things get tricky is that major stablecoins can exist on many chains at the same time. For example, USDC is available across multiple networks, not just one chain: USDC availability and overview. A good multi-chain wallet helps you manage those balances from one interface, instead of juggling apps, networks, and manual token imports.

Also note the terminology:

- Multi-chain means the wallet supports multiple networks natively.

- Cross-chain means moving value between networks (often involving bridges or cross-chain routing).

- Staking is a separate DeFi activity on a single network and should not be treated as a cross-chain function.

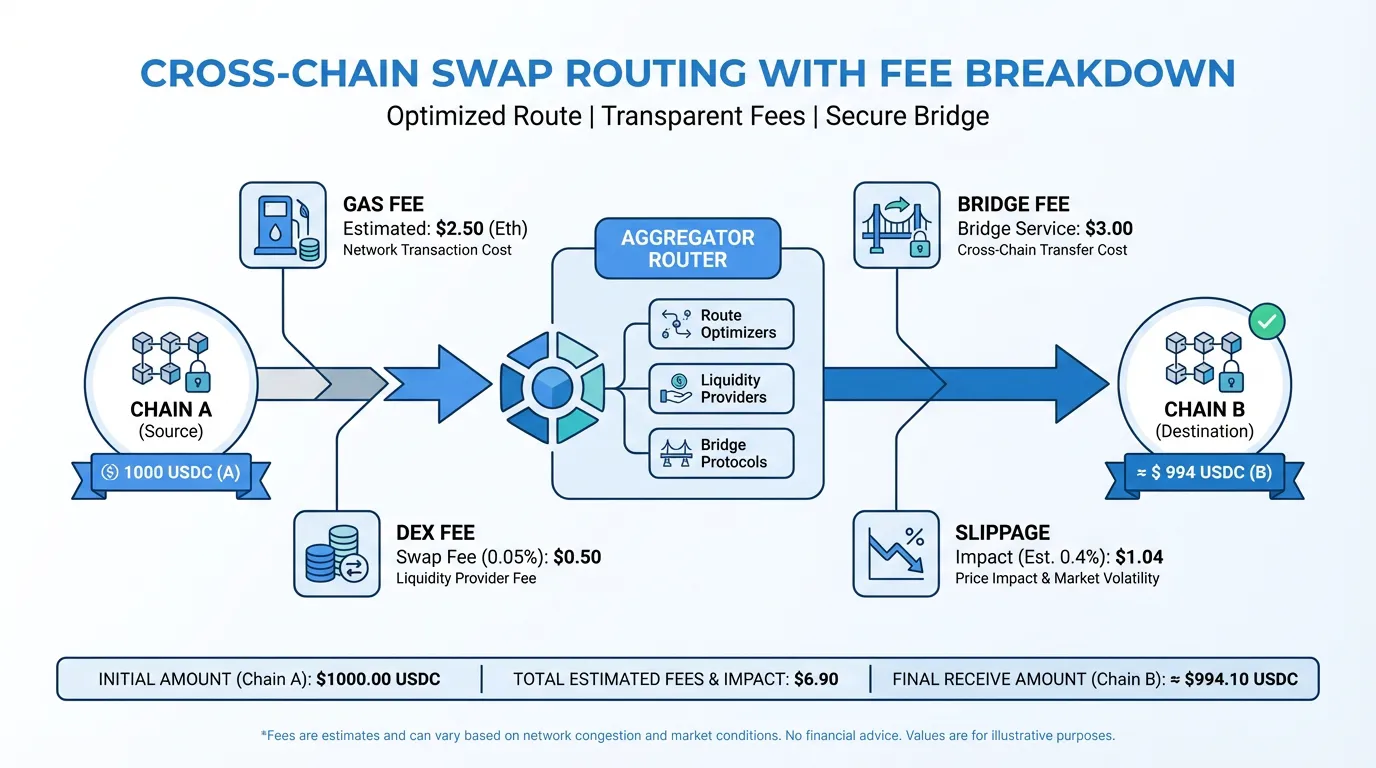

Why "low fees" is complicated: the real cost of moving stablecoins

When users say "low fees," they usually mean the all-in cost, not just one line item. A helpful breakdown of cost components (gas, bridge costs, slippage, and hidden markups) is covered here: stablecoin wallet features and how to choose.

Here is a practical fee map you can use when comparing wallets:

| Cost component | What it is | What to look for in a wallet |

|---|---|---|

| Network gas fees | Fees paid to the blockchain (varies by network) | Clear fee preview and smart network selection habits |

| DEX liquidity provider fees | Pool fees charged by DEXs (varies by pool) | Routing that finds deeper liquidity to reduce price impact |

| Cross-chain fees | Bridge or cross-chain protocol costs plus gas on both sides | Transparent route display and realistic execution estimates |

| Slippage/spread | Price impact from trade size or thin liquidity | Aggregation that optimizes routes to reduce slippage |

| Wallet-level swap service fee | An extra fee added by some wallets | Prefer wallets with fewer fixed add-on fees and clearer quoting |

Publicly disclosed fixed swap service fee (quick signal)

Some wallets publicly disclose a fixed service fee on swaps. Others do not disclose a universal percentage and may rely on DEX/route economics. The chart below only reflects whether a fixed percentage is publicly disclosed in sources, not the total execution cost (gas and DEX fees still apply).

Comparison: FoxWallet vs common alternatives for stablecoin users

All four options discussed here are non-custodial wallets in general market positioning, meaning you control your keys. If you want a clear explanation of custodial vs non-custodial tradeoffs, BitPay's guide is a straightforward read: non-custodial vs custodial wallets.

Below is a wallet comparison for stablecoin management:

| Category | FoxWallet | Trust Wallet | OKX Web3 Wallet | MetaMask |

|---|---|---|---|---|

| Multi-chain orientation | Built for multi-chain management with a unified asset view | Broad chain coverage (widely known for many networks) | Broad chain coverage with DEX routing | Strongest in EVM ecosystems; expanding beyond |

| Cross-chain swaps | Built-in cross-chain swap routing via aggregators to reduce friction | Available via integrations; flow may vary | Strong emphasis on DEX routing and cross-chain | In-wallet swaps, primarily around EVM routes |

| Swap fee posture | Positioned around lower swap fees and reduced hidden costs | Often described as no additional wallet swap fee (users still pay gas/DEX fees) | No universal fixed fee clearly disclosed | Publicly disclosed 0.875% swap service fee (plus gas) |

| Security UX | Local key encryption, sandbox isolation, pre-transaction risk alerts, contract recognition | Security tooling and token scanners vary by network | Strong security tooling and detection features | Strong transaction approval model; risks depend on user approvals |

| Platforms | Mobile and browser extension | Mobile and browser extension | Mobile and browser extension | Mobile and browser extension |

How FoxWallet is built for low-fee stablecoin management across chains

FoxWallet's product positioning is strongest when you evaluate the entire workflow: track, swap, and interact with stablecoins across multiple networks while staying in self-custody.

Key capabilities:

- Non-custodial control: your keys remain yours, with local encrypted storage and safety architecture. For official documentation and security notes, see the FoxWallet Help Center.

- Multi-chain asset management: automatic detection and a unified view that reduces the "which chain is my USDC on?" problem.

- Built-in cross-chain swaps: integrated swap aggregation that aims to route for better pricing and liquidity, helping reduce slippage and avoid unnecessary hops.

- Safer transaction decisions: pre-transaction risk alerts and smart contract recognition to help users spot suspicious approvals before signing.

- Multi-platform availability: you can start on mobile and continue on desktop via the extension. You can reference FoxWallet's official site at FoxWallet and the extension repository at FoxWallet browser extension.

Safety checklist for self-custody stablecoins (beginner to pro)

Self-custody removes exchange custody risk, but it also makes your operational security non-negotiable. Use this checklist:

- Protect your seed phrase offline. Never paste it into sites or forms.

- Verify the chain and token you are receiving. The same ticker can exist on multiple networks, and fake tokens do happen.

- Treat approvals as risk events. If a transaction requests broad permissions, slow down and validate the contract and intent.

- Watch for phishing DApps. A wallet with risk alerts helps, but your verification habits still matter.

- Be extra cautious with cross-chain moves. Bridges and cross-chain routes introduce additional risk and cost layers, so prefer wallets that show routes and risks clearly.

If your goal is a multi-chain stablecoin wallet optimized for lower total costs and smoother cross-chain swaps, start with FoxWallet, then review the security and workflow details in the FoxWallet documentation before moving larger balances.