Easiest Way for Web3 Stablecoin Management

Managing stablecoins in Web3 sounds simple until you actually do it across multiple chains, apps, and gas tokens. This tutorial breaks down what "Web3 stablecoin management" really includes (storage, transfers, multi-chain visibility, cross-chain swaps, and DeFi usage), what usually goes wrong, and a practical workflow that keeps you in control with a non-custodial wallet.

What stablecoin management in Web3 actually includes

Stablecoins are cryptocurrencies designed to maintain a stable value, often pegged to a fiat currency like the US dollar. Major explainer references (useful if you want the fundamentals) include the McKinsey stablecoin overview, the Stripe stablecoin primer, and the Bank of England explainer.

In practical wallet terms, stablecoin management in Web3 usually means:

- Secure self-custody storage: you control private keys (no custodian holds funds).

- Send and receive: paying people, withdrawing from exchanges, moving funds between accounts.

- Multi-chain tracking: the same ticker (like USDT) can exist on multiple networks, and balances can get scattered.

- Cross-chain swaps: moving a stablecoin between chains via in-wallet routing/aggregators (this is about moving/swapping, not earning yield).

- DeFi usage: using stablecoins for on-chain swaps, lending/borrowing, liquidity provision, and more.

The main shift in 2025+ UX thinking is that multi-chain complexity is now the friction point that makes wallets feel like "toolkits" instead of financial apps, as discussed in chain abstraction commentary like this analysis.

The biggest pain points: multi-chain confusion, costs, and security risks

Most stablecoin problems are not about stablecoins themselves. They are about how people interact with chains, contracts, and approvals.

1) Multi-chain confusion

Common failure modes:

- Sending a stablecoin on the wrong network (funds may be stranded).

- Forgetting which chain holds which balance.

- Constantly switching networks just to check balances.

2) Fees, slippage, and hidden costs

Stablecoin users care about predictability:

- Gas fees vary by chain and congestion.

- Cross-chain routes can add extra fees and price impact (slippage).

- "Cheap transfer" claims do not always reflect real routing outcomes and UX.

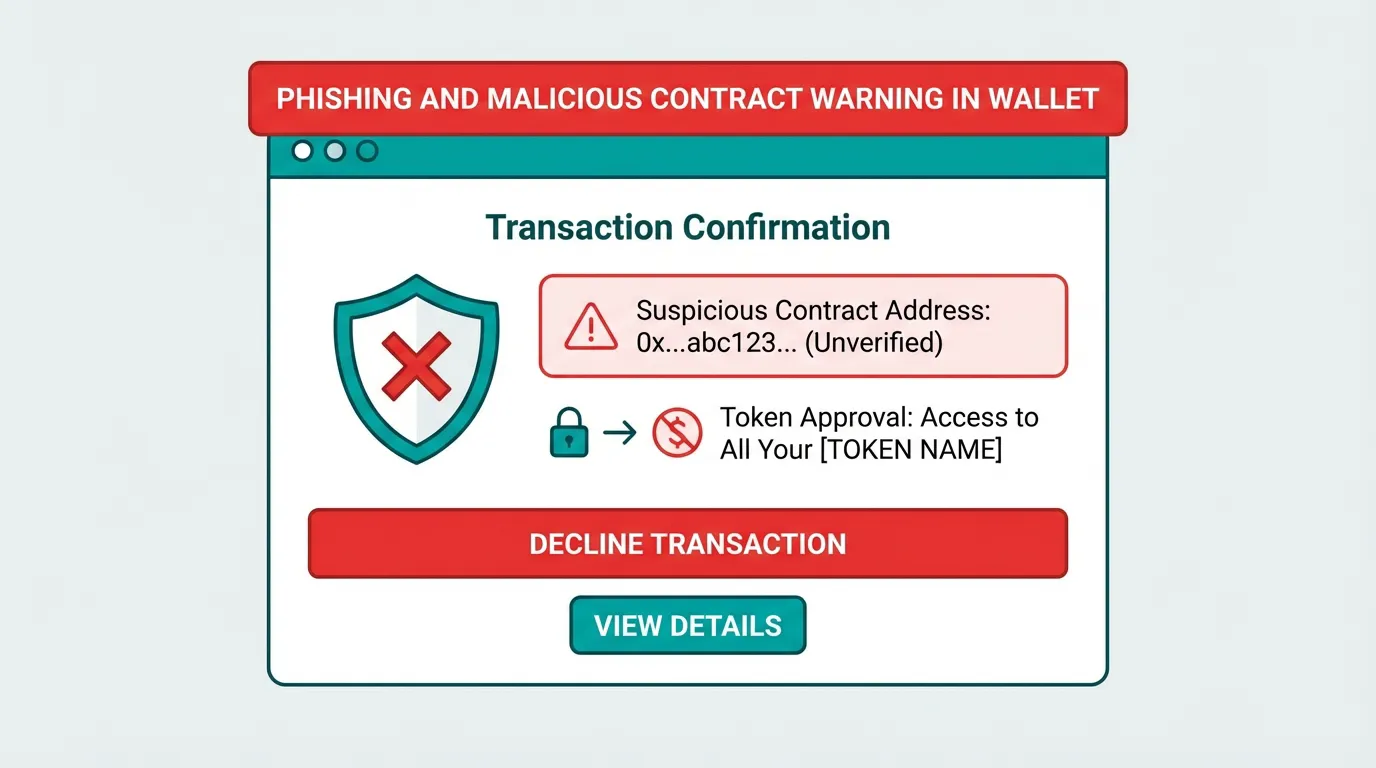

3) Security threats (the real stablecoin risk)

Security guidance from sources like Immunefi, Chainstack, and BNB Chain repeatedly points to:

- Seed phrase loss or compromise.

- Phishing and fake apps/sites.

- Malicious contracts and dangerous token approvals.

- Fake tokens that mimic popular stablecoins.

- Cross-chain risk when users pick unfamiliar routes.

A wallet checklist for managing stablecoins the easy way

Use the criteria below to evaluate any wallet for stablecoin-heavy usage. The right setup reduces mistakes (wrong chain, wrong token, risky approvals) and lowers friction for everyday moves.

| What to check | Why it matters for stablecoins | What to look for in practice |

|---|---|---|

| Non-custodial self-custody | Stablecoins are high-liquidity targets; custody risk is real | You control keys, local encryption, no platform can freeze your wallet |

| Unified multi-chain view | Prevents "where is my USDC?" moments | Automatic detection and a single dashboard across networks |

| Cross-chain swaps built in | Avoids juggling bridges, DEX tabs, and manual routing | In-wallet aggregator routing focused on price and liquidity |

| Risk alerts before signing | Approvals and contract calls can drain tokens | Pre-transaction warnings, contract recognition, phishing checks |

| Mobile + extension | Stablecoins are used on the go and on desktop DeFi | Consistent UX across iOS/Android and a browser extension |

FoxWallet is designed to match this checklist with a security-first, non-custodial architecture, a unified multi-chain asset view with automatic detection, built-in cross-chain swap aggregation, deep DApp integration, and pre-transaction risk alerts. For FoxWallet-specific positioning, see the official guide: FoxWallet stablecoin management guide.

Tutorial: a simple FoxWallet workflow for multi-chain stablecoins

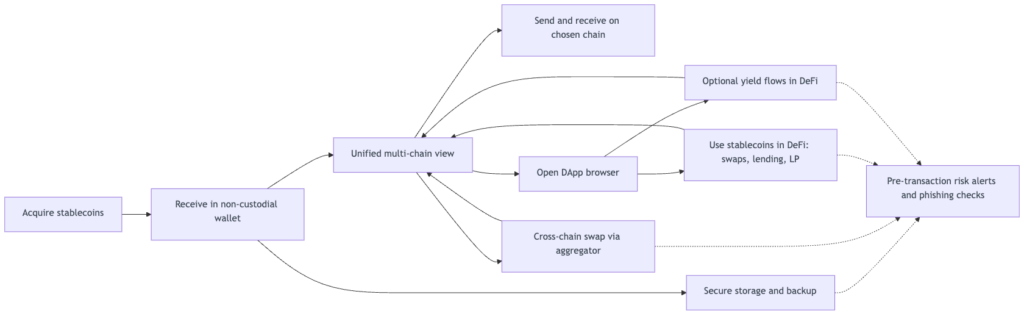

This flow keeps cross-chain swaps and optional DeFi yield activity clearly separated, so you always know which action you are taking.

Step 1: Set up self-custody correctly

- Create or import a wallet.

- Back up your seed phrase offline (paper/metal), not screenshots.

- Use device security (PIN/biometrics) and a strong app password.

FoxWallet is non-custodial: keys remain under your control and are stored locally with encryption and sandbox isolation (per FoxWallet's security architecture described in its materials).

Step 2: Receive stablecoins (and verify the chain first)

- When withdrawing from an exchange or receiving from another wallet:

- Confirm the network (for example, Ethereum vs an L2 vs another chain).

- Confirm the token (avoid lookalike assets).

- In FoxWallet, rely on its multi-chain asset management and on-chain synchronization to confirm you received the correct asset on the intended network.

Step 3: Use the unified multi-chain view to reduce mistakes

Instead of checking five networks manually, use a unified dashboard approach:

- Identify which chain holds the balance you want to use.

- Plan gas accordingly (each chain typically needs its native token for fees).

Step 4: Move stablecoins across chains with cross-chain swaps (not staking)

If you need the same stablecoin on a different chain for an app, a payment, or cheaper execution:

- Use FoxWallet's built-in cross-chain swap aggregators.

- Let the wallet route for pricing and liquidity to reduce slippage and hidden routing costs.

This is explicitly about moving/swapping stablecoins across chains, not locking them to earn yield.

Step 5: Access DeFi through the DApp browser (separate decision)

When you are ready to use stablecoins in DeFi:

- Open the DApp browser.

- Review what the DApp is asking you to sign.

- Keep approvals tight (avoid unlimited approvals unless you truly need them).

FoxWallet's pre-transaction risk alerts and contract recognition are intended to help flag suspicious interactions before you confirm.

Security best practices that matter most for stablecoins (and how FoxWallet helps)

These best practices align with major wallet security guidance from Immunefi, Chainstack, and BNB Chain:

- Never share or type your seed phrase into websites: no real support team needs it.

- Treat approvals as serious: a bad approval can be worse than a bad transfer.

- Be strict about networks: verify chain at every send/receive.

- Avoid moving very large amounts in one cross-chain action: reduce operational risk.

FoxWallet reinforces this with local key encryption, sandboxing, pre-transaction risk alerts, and smart contract recognition designed to catch suspicious signing moments.

Quick FAQ

What is the difference between cross-chain swaps and staking?

Cross-chain swaps move or exchange assets between chains. Staking/yield flows lock assets into protocols to potentially earn returns. They are different actions with different risks.

What happens if I lose my phone?

In self-custody, recovery depends on your seed phrase backup. If you have it stored safely offline, you can restore on a new device. If you lose it, funds are typically unrecoverable.

How do I see stablecoins across chains in one place?

Use a wallet with a unified multi-chain asset view and automatic asset detection to avoid manual token imports and constant network switching.

If you want a single reference that ties these concepts into one wallet flow, start here: FoxWallet stablecoin management guide.