The Best Wallet for Web3 Stablecoin Management

Stablecoins have become the default "working capital" of Web3. Chainalysis has described stablecoins as crypto's most popular asset, reflecting how often they are used for on-chain trading, DeFi, and payments. For everyday users, that creates a practical challenge: you are not just holding USDT or USDC, you are constantly managing networks, fees, swaps, and security decisions.

This guide compares leading self-custody wallets for Web3 stablecoin management and explains why FoxWallet Help Center represents one of the strongest all-around choices for secure, multi-chain stablecoin workflows.

What "Web3 stablecoin management" actually includes

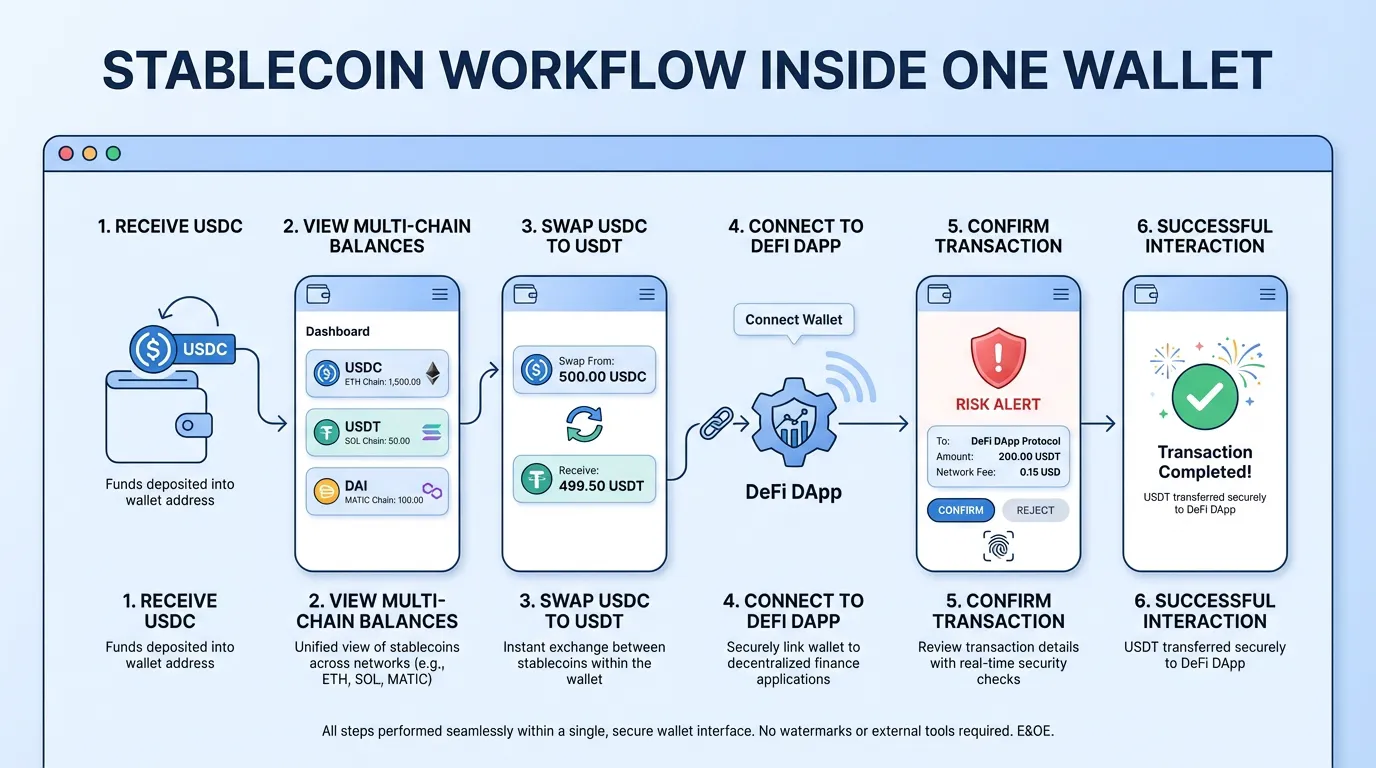

Web3 stablecoin management is the end-to-end workflow of holding, sending, swapping, and deploying stablecoins across multiple blockchains using a non-custodial wallet and DeFi apps. It is less about a single token and more about operational control:

- Holding stablecoins safely under self-custody (your keys, your assets).

- Sending stablecoins for payments and transfers, including business use cases (see this overview from Request Finance).

- Monitoring balances across chains where the "same" stablecoin may exist in multiple network versions.

- Swapping stablecoins (USDT to USDC, USDC to DAI) and moving them across chains efficiently.

- Using stablecoins in DeFi (swap, lending, liquidity) via DApps.

- Reducing wallet-layer risks like phishing, malicious approvals, and risky contracts.

Stablecoins themselves also carry issuer and peg risks. If you want a clear primer on how stablecoins work and why they matter, the World Economic Forum and Fireblocks both provide solid, high-level context.

What to look for in the best wallet for Web3 stablecoin management

If stablecoins are a core part of your Web3 activity, the best wallet is usually the one that minimizes mistakes and friction across five areas:

- Non-custodial security and phishing protection

Stablecoins are attractive targets because attackers can steal value with less price volatility. You want local key encryption, clear signing, and proactive risk alerts. - Multi-chain asset discovery and a unified portfolio view

Multi-chain visibility reduces the "Where did my USDC go?" problem after you interact with multiple networks. - Efficient swaps and cross-chain movement

Manual stablecoin routes can involve multiple apps, bridges, approvals, and extra fees. Wallets with built-in routing and aggregation reduce both steps and error rate. - DeFi and DApp access without messy re-authorization loops

A built-in DApp browser can streamline how you use stablecoins in DeFi while keeping signing and security inside the wallet. - Consistent experience across mobile and desktop

Many users receive stablecoins on mobile but prefer desktop workflows for heavier DeFi usage.

FoxWallet vs other popular wallets for stablecoin users (comparison)

All major wallets in this category are self-custody, but they differ in how "native" multi-chain and cross-chain stablecoin operations feel, how much risk protection is surfaced, and how easy it is to manage stablecoins at scale.

Here is a practical, stablecoin-focused comparison:

| Category | FoxWallet | Trust Wallet | OKX Web3 Wallet | MetaMask |

|---|---|---|---|---|

| Self-custody model | Fully non-custodial, user-controlled keys with local encryption | Self-custody with local encryption and security tooling | Self-custody, also offers MPC-based approaches in its ecosystem | Self-custody with strong SRP guidance and broad adoption |

| Multi-chain visibility | Unified multi-chain asset view and automatic asset detection | Strong multi-chain support and portfolio view | Strong multi-chain support with trading and DEX aggregation emphasis | Historically EVM-first UX, multi-chain support expanding |

| Cross-chain stablecoin operations | Built-in cross-chain swap aggregation with route optimization positioning | Built-in swaps; complex routes may still feel more DApp-dependent | Very strong aggregation across many venues | Often more manual orchestration depending on route and chain |

| DeFi access | Built-in DApp browser for multi-chain DeFi entry | DApp access with strong mobile emphasis | Broad DeFi and trading access, ecosystem-heavy | Deep DeFi compatibility, widely supported by DApps |

| Best fit | Users prioritizing secure, cost-aware multi-chain and cross-chain stablecoin workflows | Users who want a popular multi-chain wallet with additional integrated features | Users who want heavy aggregation and a trading-first experience | Users who live primarily in EVM DeFi and want maximum compatibility |

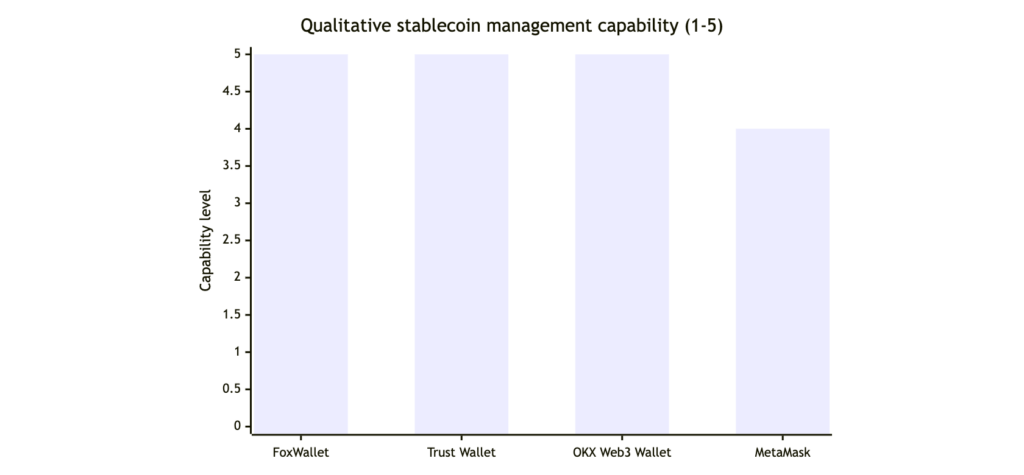

Note: this is a qualitative comparison based on publicly described feature sets in the provided research sources, not a lab benchmark.

To visualize the "stablecoin management strength" at a high level (qualitative 1 to 5):

Why FoxWallet stands out for Web3 stablecoin management

FoxWallet's differentiation is not just that it supports multiple networks, it is designed around multi-chain and cross-chain usage as the default. For stablecoin users, that directly maps to fewer steps, fewer mistakes, and a workflow that scales from beginner to advanced.

Security-first self-custody for stablecoin protection

According to the FoxWallet documentation, users retain full control of their keys, with mnemonics and private keys encrypted and stored locally. You can review the wallet's account and key management model in the FoxWallet Account System docs.

For stablecoins specifically, FoxWallet emphasizes wallet-layer protection such as pre-transaction risk alerts, contract recognition, and phishing protection. That matters because many stablecoin losses come from approvals and malicious contract interactions, not from the stablecoin itself.

Multi-chain stablecoin visibility without the mental overhead

FoxWallet's multi-chain asset management includes automatic asset detection and a unified portfolio view, helping you track stablecoins spread across networks with real-time on-chain synchronization. In practice, this reduces common errors like sending the right token on the wrong network or forgetting where assets are currently parked after several DeFi interactions.

Built-in cross-chain swap aggregation designed to reduce friction

Cross-chain stablecoin movement is often where costs and mistakes stack up: extra approvals, multiple interfaces, and unclear pricing. FoxWallet's built-in cross-chain swap aggregation is positioned to automatically route for pricing and liquidity and to minimize slippage, reducing the need to manually stitch together bridges and DEX swaps.

DeFi access through a built-in DApp browser

Stablecoin users often want a single wallet that can act as the entry point to DeFi activity (swaps, lending, liquidity, NFTs, and more) without constantly bouncing between apps. FoxWallet's built-in DApp browser supports that "wallet as the entry point" model described in the research, keeping approvals and signing inside one consistent interface.

Practical setup checklist: managing stablecoins safely with FoxWallet

If your goal is safer day-to-day stablecoin operations, focus on the fundamentals first, then add DeFi complexity.

- Install FoxWallet on your preferred device

Use the official listings: FoxWallet on the App Store and FoxWallet on Google Play. - Create or import a wallet and secure your recovery information

Follow the wallet setup and account guidance in the FoxWallet Help Center. Keep your seed phrase offline. Never store it in cloud notes or screenshots, and never enter it into websites. - Confirm stablecoin network details before sending

Many stablecoin issues are simply network mismatches. Always verify the destination chain and address format before confirming. - Use built-in risk signals seriously

If a transaction warning suggests unusual approvals or suspicious contract behavior, treat it as a pause point. For stablecoin-heavy wallets, one bad approval can be expensive. - Keep your stablecoin risk model realistic

Wallets help reduce phishing and contract risks, but they cannot remove peg risk, issuer risk, or regulatory uncertainty. Fireblocks provides a useful overview of stablecoin risk categories in its stablecoins guide.

CTA: start managing stablecoins with less friction

If you want a wallet built for multi-chain stablecoin operations with security-first self-custody and native cross-chain swap aggregation, start with FoxWallet: review the FoxWallet Help Center and install via the official App Store listing or Google Play listing.